Financing options designed specifically for veterinary care can provide pet owners with a way to manage the costs of unexpected illnesses, injuries, or routine procedures. For example, these plans can help cover expenses such as emergency surgery, hospitalization, diagnostic testing, and even preventative care like vaccinations and dental cleanings.

Access to flexible payment solutions can be crucial in ensuring pets receive necessary medical attention promptly, potentially avoiding delays that could worsen a pet’s condition. Historically, pet owners often faced limited options for managing significant veterinary bills, sometimes forcing difficult decisions regarding their animal’s health. The availability of specialized financing helps alleviate this burden, allowing owners to prioritize their pet’s well-being without immediate financial strain. This can ultimately lead to better health outcomes for pets and greater peace of mind for their owners.

This article will explore various aspects of veterinary financing, including available plan types, eligibility criteria, application processes, and responsible usage guidelines. Further discussion will cover potential benefits and drawbacks, comparing different providers and offering practical tips for managing pet healthcare expenses.

Tips for Utilizing Veterinary Financing

Proper planning and responsible utilization of veterinary financing options are crucial for maximizing benefits and avoiding potential financial pitfalls. The following tips offer guidance for navigating these programs effectively.

Tip 1: Understand the Terms and Conditions: Carefully review the interest rates, fees, repayment periods, and any potential penalties associated with the financing plan. Compare offerings from different providers to identify the most favorable terms.

Tip 2: Budget Responsibly: Calculate anticipated veterinary expenses and determine a comfortable monthly payment amount before committing to a financing plan. Ensure the chosen plan aligns with long-term budgetary constraints.

Tip 3: Explore Alternative Options: Consider pet insurance or establishing a dedicated savings account for pet healthcare expenses as potential alternatives or supplements to financing plans.

Tip 4: Prioritize Essential Care: Utilize financing for necessary medical treatments and procedures, focusing on those that significantly impact a pet’s health and well-being.

Tip 5: Communicate with Your Veterinarian: Discuss anticipated costs and available payment options with the veterinary clinic beforehand. This ensures transparency and facilitates informed decision-making regarding treatment plans.

Tip 6: Make Timely Payments: Adhere to the agreed-upon repayment schedule to avoid late payment fees and potential negative impacts on credit scores.

Tip 7: Keep Records Organized: Maintain detailed records of all transactions, including applications, loan agreements, and payment confirmations. This simplifies tracking expenses and facilitates accurate record-keeping.

By following these guidelines, pet owners can effectively utilize veterinary financing options to manage healthcare costs while ensuring responsible financial planning.

This information provides a foundation for navigating veterinary financing. Consult with a financial advisor for personalized guidance tailored to individual circumstances.

1. Veterinary Financing

Veterinary financing provides a mechanism for pet owners to manage the often substantial costs associated with animal healthcare. Specifically, it offers an alternative to immediate, out-of-pocket payment for services ranging from routine check-ups and vaccinations to emergency procedures and long-term treatments. This is particularly relevant in the context of specialized financing options tailored for pet care, such as dedicated credit lines.

- Deferred Interest and Promotional Periods:

Many veterinary financing plans offer deferred interest periods or promotional rates for a set duration. For example, a plan might offer 0% interest for 12 months on purchases over a certain amount. This can be advantageous for managing larger expenses, provided the balance is paid in full within the promotional timeframe. However, understanding the terms and conditions, including the interest rate applied after the promotional period expires, is critical. Failure to repay the balance within the promotional period can result in retroactive interest charges.

- Credit Line vs. Loan:

Veterinary financing can take the form of a dedicated credit line or a traditional loan. A credit line offers revolving credit specifically for veterinary services, allowing repeated borrowing up to a pre-approved limit. A loan, conversely, provides a fixed amount for a specific purpose with a predetermined repayment schedule. Choosing the appropriate option depends on individual needs and anticipated expenses.

- Impact on Credit Scores:

Applications for veterinary financing typically involve a credit check, which can potentially impact credit scores. Furthermore, late or missed payments can negatively affect credit history. Responsible usage, including timely payments and staying within credit limits, is essential for maintaining a healthy credit profile.

- Application and Approval Process:

The application process typically involves providing personal and financial information. Approval decisions are based on creditworthiness and other factors. Pre-approval options can streamline the process and offer insights into available credit limits before committing to a specific financing plan.

By understanding the components of veterinary financing, pet owners can make informed decisions regarding their animal’s healthcare. Carefully evaluating the terms, benefits, and potential risks associated with these options is essential for responsible financial planning and ensuring access to necessary veterinary services. Comparing various financing plans, considering alternatives like pet insurance, and communicating openly with veterinary professionals contribute to a comprehensive approach to managing pet healthcare costs.

2. Application Process

The application process for veterinary financing specifically designed for pet care, often branded as “Care Credit for pets,” is a critical step in accessing this financial resource. This process typically involves several stages, beginning with the submission of an application either online or through a participating veterinary clinic. Applicants provide personal information, including name, address, and contact details, alongside financial information such as income and employment history. A credit check is routinely performed to assess creditworthiness and determine eligibility. The outcome of the application, whether approval or denial, is typically communicated within a short timeframe, sometimes instantaneously for online applications. The application process serves as the gateway to accessing credit specifically allocated for pet healthcare expenses.

The efficiency and accessibility of the application process directly impact a pet owner’s ability to secure timely financial assistance for necessary veterinary care. A streamlined online application, for example, can expedite access to funds for emergency procedures, while a lengthier, more complex process might introduce delays. Consider a scenario where a pet requires immediate surgery: a rapid application and approval process can facilitate prompt treatment, potentially mitigating further complications. Conversely, a delayed application process might necessitate alternative arrangements or postpone essential care. Understanding the application process and its potential implications is therefore crucial for responsible pet ownership.

In summary, the application process for specialized pet care financing is a pivotal component. Its efficiency and accessibility significantly influence a pet owner’s capacity to secure timely financial resources for veterinary services. Understanding the steps involved, including the credit check and required information, allows pet owners to navigate the process effectively and make informed decisions regarding their pet’s healthcare. This proactive approach empowers pet owners to anticipate potential challenges and ensure access to critical financial assistance when needed.

3. Eligibility Requirements

Access to specialized financing for veterinary care, often referred to as “Care Credit for pets,” hinges on meeting specific eligibility criteria. These requirements serve to assess an applicant’s financial stability and ability to manage credit responsibly. Understanding these prerequisites is essential for prospective applicants seeking to utilize such financial resources for pet healthcare expenses.

- Credit History:

Applicants’ credit histories play a significant role in determining eligibility. Lenders typically review credit reports, evaluating factors like payment history, outstanding debt, and credit utilization. A positive credit history, characterized by consistent on-time payments and responsible credit management, generally increases the likelihood of approval and may influence offered interest rates and credit limits. Conversely, a negative credit history, marked by late payments, defaults, or high debt levels, could result in application denial or less favorable terms.

- Income and Employment:

Stable income and verifiable employment are often considered during the application process. Lenders seek assurance that applicants possess the financial capacity to repay borrowed funds. Providing proof of income, such as pay stubs or tax returns, may be required. While specific income thresholds may vary among lenders, demonstrating a consistent income stream strengthens an application and reinforces financial stability.

- Legal Age and Residency:

Applicants must typically meet minimum age requirements and demonstrate legal residency within the applicable jurisdiction. These requirements align with legal and regulatory standards governing financial agreements. Proof of age and residency, such as a driver’s license or government-issued identification, may be necessary during the application process.

- Other Financial Obligations:

Existing debt obligations, such as loans or credit card balances, can influence eligibility. Lenders assess an applicant’s overall debt-to-income ratio, which compares total debt payments to gross income. A high debt-to-income ratio might indicate financial strain and could impact the likelihood of approval. Managing existing debt responsibly contributes to a stronger financial profile and potentially improves eligibility prospects.

Meeting these eligibility requirements enhances the likelihood of accessing specialized financing options for pet care. A thorough understanding of these criteria enables prospective applicants to assess their eligibility proactively and take steps to improve their financial standing, ultimately facilitating access to necessary financial resources for pet healthcare. This preparation contributes to responsible pet ownership and ensures access to critical veterinary services when needed.

4. Responsible Usage

Responsible usage of veterinary financing options, including dedicated credit lines for pet care, forms the cornerstone of sound financial management within the context of animal healthcare. It directly impacts both the pet owner’s financial well-being and the pet’s access to necessary medical care. This responsible approach entails a comprehensive understanding of the financing terms, a commitment to budgetary prudence, and a prioritization of essential veterinary services. The potential consequences of irresponsible usage, such as escalating debt and compromised credit ratings, underscore the critical nature of this principle. For instance, utilizing credit to cover routine check-ups while neglecting a significant medical condition due to cost concerns demonstrates a misapplication of this financial tool. Conversely, strategically employing credit to manage the unexpected expense of emergency surgery, followed by diligent repayment according to the agreed-upon terms, exemplifies responsible usage. This judicious approach ensures access to critical care while mitigating potential financial strain.

The practical implications of responsible usage extend beyond individual financial health. Veterinary practices also benefit from clients’ ability to manage healthcare costs effectively. This facilitates timely access to necessary treatments, potentially improving patient outcomes. Moreover, responsible usage fosters a sustainable financial environment within the veterinary industry, promoting continued investment in advanced medical technologies and specialized care options. Consider the scenario of a pet owner facing a substantial veterinary bill. Responsible usage of financing enables prompt treatment, preventing potential complications and reducing the likelihood of prolonged, more costly interventions. This, in turn, allows veterinary professionals to deliver optimal care and contribute to improved animal welfare. The interconnectedness of responsible usage, financial stability, and access to quality veterinary care underscores its importance.

In conclusion, responsible usage of veterinary financing options constitutes a critical component of pet ownership. It requires a balanced approach to utilizing credit, prioritizing essential care, and adhering to agreed-upon repayment terms. Understanding the potential consequences of irresponsible usage, alongside the broader benefits of prudent financial management, empowers pet owners to make informed decisions that support both their pet’s well-being and their own financial health. This responsible approach not only facilitates access to essential veterinary services but also contributes to the sustainability of the veterinary industry and the advancement of animal healthcare.

5. Benefit Assessment

Benefit assessment, within the context of specialized veterinary financing options such as those marketed as “Care Credit for pets,” constitutes a critical evaluation process. This process weighs the advantages of accessing immediate veterinary care against the financial implications of utilizing credit. A comprehensive benefit assessment considers factors such as interest rates, repayment terms, and potential long-term costs, ultimately informing responsible decision-making regarding pet healthcare expenditures.

- Immediate Access to Care:

A primary benefit of veterinary financing lies in enabling immediate access to necessary medical treatments, even in the absence of readily available funds. This can be particularly crucial in emergency situations where delaying treatment could significantly compromise a pet’s health. For instance, financing can facilitate prompt surgical intervention for a fractured limb, preventing further complications and potentially reducing long-term recovery time. However, the benefit of immediate care must be weighed against the financial obligations incurred.

- Managing Unexpected Expenses:

Unexpected veterinary expenses can impose a substantial financial burden on pet owners. Financing options provide a mechanism for managing these unforeseen costs, spreading payments over time and mitigating the impact on personal finances. Consider the scenario of a pet requiring extensive diagnostic testing. Financing allows owners to pursue necessary diagnostics without incurring immediate, potentially prohibitive expenses, facilitating timely diagnosis and treatment.

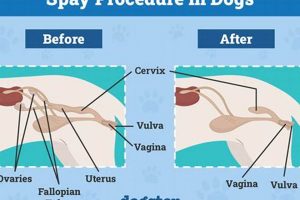

- Planned Procedures and Preventative Care:

While often associated with emergency situations, veterinary financing can also support planned procedures and preventative care. This allows owners to budget for expenses such as dental cleanings, spaying/neutering, or other elective procedures, ensuring access to comprehensive veterinary services without compromising financial stability. However, carefully evaluating the cost of financing against potential long-term health benefits remains essential.

- Balancing Cost and Benefit:

The core of benefit assessment involves balancing the cost of financing against the potential benefits to the pet’s health and well-being. Factors such as interest rates, repayment terms, and the overall cost of credit must be carefully considered. Comparing financing options, exploring alternative solutions like pet insurance, and discussing anticipated expenses with veterinary professionals contribute to informed decision-making and responsible financial planning.

A comprehensive benefit assessment is integral to utilizing veterinary financing responsibly. By carefully weighing the advantages of accessing credit against the associated financial obligations, pet owners can make informed decisions that prioritize their pet’s health while maintaining financial stability. This process underscores the importance of considering both immediate needs and long-term implications when navigating veterinary healthcare expenses.

Frequently Asked Questions about Financing Veterinary Care

This section addresses common inquiries regarding specialized financing options designed for veterinary expenses.

Question 1: What types of veterinary services are typically eligible for coverage under these financing plans?

Eligible services often include emergency treatments, surgeries, diagnostic testing, hospitalization, preventative care such as vaccinations and dental cleanings, and medications. Specific coverage details vary among providers.

Question 2: How does the application process typically work, and what information is generally required?

Applications typically involve submitting personal and financial information, including income, employment history, and address. A credit check is routinely conducted. Applications are submitted online or through participating veterinary clinics.

Question 3: What factors influence approval decisions, and what are common reasons for application denial?

Approval decisions primarily hinge on credit history, income stability, and existing debt levels. Common denial reasons include poor credit scores, insufficient income, or excessive outstanding debt. Meeting minimum age and residency requirements is also essential.

Question 4: What are the typical interest rates and repayment terms associated with these financing options?

Interest rates and repayment terms vary significantly among providers and depend on individual creditworthiness. Promotional periods with deferred interest may be available but often transition to higher rates upon expiration. Carefully reviewing terms and conditions is critical.

Question 5: Are there potential penalties for late or missed payments, and how might these impact credit scores?

Late or missed payments can incur penalties, including late fees and increased interest rates. These delinquencies can also negatively impact credit scores, potentially affecting future access to credit. Adhering to the agreed-upon payment schedule is crucial.

Question 6: What alternatives to specialized financing exist for managing veterinary expenses, and what are their respective advantages and disadvantages?

Alternatives include pet insurance, personal savings accounts dedicated to pet healthcare, and negotiating payment plans directly with veterinary clinics. Pet insurance offers coverage for unexpected illnesses and injuries, while savings accounts provide readily available funds. Negotiated payment plans may offer flexibility but might not cover all expenses.

Careful consideration of these frequently asked questions empowers pet owners to navigate financing options effectively and make informed decisions regarding their pet’s healthcare.

The subsequent section will delve into specific examples and case studies illustrating the practical application of these financing options in various veterinary care scenarios.

Financial Resources for Canine Healthcare

This exploration of financial resources for canine healthcare, often referred to as “care credit for dog,” has provided a comprehensive overview of available options, application processes, eligibility requirements, and responsible usage guidelines. Key takeaways include the importance of understanding financing terms, comparing various providers, and budgeting responsibly. Furthermore, the discussion emphasized the potential benefits of accessing necessary veterinary care promptly while mitigating financial strain. Alternatives such as pet insurance and dedicated savings accounts were also considered, offering a holistic perspective on managing canine healthcare expenses.

Access to appropriate financial resources plays a crucial role in ensuring pets receive necessary medical attention. Thoughtful planning, informed decision-making, and responsible financial management contribute significantly to a pet’s overall well-being. Continued exploration of innovative financing solutions and educational resources empowers pet owners to navigate healthcare costs effectively and prioritize their animals’ health.