Financing veterinary care for canines can be a significant concern for pet owners. Specialized credit cards designed for pet health expenses allow owners to access necessary treatments and procedures, even in emergencies, by offering a line of credit specifically for these costs. For example, a dog requiring unexpected surgery could receive immediate treatment with such a card, avoiding potential delays due to financial constraints.

Accessible veterinary financing provides a crucial safety net, enabling proactive and timely pet healthcare. This can lead to improved health outcomes for pets and reduced financial stress for owners facing unexpected veterinary bills. Historically, options for financing animal care were limited, often requiring owners to deplete savings or forgo essential treatments. The development of dedicated credit lines for pet health represents a significant advancement in responsible pet ownership.

This article will further explore the various aspects of financing options for canine healthcare, including the application process, responsible credit management, and alternative financial resources for pet owners.

Tips for Managing Veterinary Expenses

Planning for the financial responsibilities of pet ownership is crucial. The following tips offer guidance on navigating veterinary costs and utilizing available financial resources effectively.

Tip 1: Understand the terms and conditions. Carefully review interest rates, fees, and repayment schedules associated with any financing option before committing. Compare options from various providers to identify the most suitable terms.

Tip 2: Establish a budget for routine pet care. Regular checkups, vaccinations, and preventative medications contribute significantly to long-term pet health. Budgeting for these expenses avoids financial surprises and promotes proactive wellness care.

Tip 3: Research veterinary costs in advance. Inquire about estimated costs for common procedures and treatments in your area. This allows for informed decision-making and facilitates proactive financial planning for potential health issues.

Tip 4: Explore pet insurance options. Pet insurance can help mitigate the financial burden of unexpected illnesses or injuries. Evaluate different coverage plans to determine the best fit for your pet’s breed, age, and health status.

Tip 5: Consider establishing an emergency fund. A dedicated savings account for pet-related emergencies can provide a financial buffer for unexpected veterinary expenses, reducing reliance on credit in critical situations.

Tip 6: Communicate openly with your veterinarian. Discuss financial constraints with your veterinarian to explore cost-effective treatment options and payment plans. Open communication ensures access to necessary care while managing budgetary limitations.

Tip 7: Utilize available resources. Research local animal welfare organizations, charitable foundations, and veterinary schools that may offer financial assistance programs for pet owners facing economic hardship.

By implementing these strategies, pet owners can effectively manage veterinary expenses, ensuring their companions receive necessary care while maintaining financial stability.

In conclusion, responsible financial planning and informed decision-making are essential for navigating the costs associated with pet ownership and ensuring the long-term health and well-being of canine companions.

1. Veterinary Financing

Veterinary financing plays a crucial role in ensuring access to necessary healthcare for dogs. Specialized credit options designed for pet care expenses, often referred to as “care credit” for dogs, represent a significant component of this financing landscape. Understanding the various facets of veterinary financing empowers pet owners to make informed decisions regarding their dogs’ health and well-being.

- Emergency Funds

Establishing an emergency fund specifically for pet-related expenses provides a financial buffer for unexpected veterinary costs. This proactive approach reduces reliance on credit during critical situations, mitigating potential debt accumulation. For instance, an emergency fund can cover the immediate costs of treating a sudden illness or injury, while a credit line can supplement the fund for more extensive procedures.

- Specialized Credit Lines

Dedicated credit lines for pet healthcare offer a flexible payment solution for veterinary expenses. These lines of credit typically feature specific terms and conditions tailored to the needs of pet owners, including deferred interest options or promotional periods. Utilizing such credit responsibly can enable access to essential treatments and procedures without depleting personal savings.

- Pet Insurance

Pet insurance policies provide coverage for a range of veterinary services, including routine checkups, emergency care, and surgical procedures. While monthly premiums contribute to ongoing costs, pet insurance can significantly reduce out-of-pocket expenses in the event of unexpected illnesses or injuries, complementing other financing options like credit lines.

- Payment Plans

Many veterinary clinics offer flexible payment plans to assist pet owners in managing the cost of treatments. These plans often involve structured installments, allowing owners to spread payments over a defined period. Negotiating a payment plan directly with the veterinary provider can alleviate immediate financial strain while ensuring access to necessary care.

Each of these financing options contributes to the overall framework of veterinary care accessibility. Integrating various strategies, such as combining an emergency fund with a specialized credit line or supplementing insurance coverage with a payment plan, allows pet owners to navigate the financial demands of dog ownership responsibly. This comprehensive approach ensures pets receive essential veterinary care without compromising long-term financial stability.

2. Credit Access

Access to credit plays a pivotal role in enabling responsible pet ownership, particularly in situations requiring unforeseen veterinary expenses. The ability to secure financing for canine healthcare, often facilitated by specialized credit lines designed for pet owners, directly impacts a dog’s access to timely and necessary treatment. Exploring the facets of credit access reveals its crucial function in navigating the financial demands of pet ownership.

- Application Process

The application process for veterinary credit lines typically involves providing personal and financial information, similar to other credit applications. Creditworthiness assessments determine eligibility and available credit limits. Streamlined online applications expedite the process, enabling rapid access to funds during emergencies. A straightforward application procedure can be the difference between timely intervention and delayed treatment for a pet requiring urgent care.

- Credit Limits and Interest Rates

Approved credit limits and associated interest rates directly influence the affordability and long-term financial implications of utilizing credit for veterinary care. Higher credit limits provide greater flexibility in addressing extensive treatments, while competitive interest rates minimize the overall cost of borrowing. Understanding these factors empowers pet owners to make informed decisions regarding financing options.

- Responsible Credit Management

Utilizing credit responsibly is essential for maintaining financial stability while ensuring access to necessary veterinary services. Timely repayments and adherence to credit terms prevent escalating debt and preserve creditworthiness. Prudent credit management practices enable pet owners to leverage credit effectively as a financial tool without incurring undue financial burden.

- Impact on Veterinary Care Accessibility

Accessible credit significantly expands treatment options for dogs, particularly in emergency situations or when facing costly procedures. It bridges the gap between immediate financial constraints and essential veterinary care, ensuring timely interventions that can significantly impact a dog’s health outcome. Credit access, therefore, plays a critical role in promoting responsible pet ownership by enabling access to quality veterinary services.

These facets of credit access highlight its integral role in facilitating responsible pet ownership and ensuring dogs receive necessary veterinary care. By understanding the application process, credit terms, and the importance of responsible credit management, pet owners can effectively leverage financial resources to prioritize their dogs’ health and well-being while maintaining financial stability. Access to credit empowers pet owners to make informed decisions, ultimately contributing to improved outcomes in canine healthcare.

3. Dog Health Emergencies

Dog health emergencies represent a critical juncture where immediate veterinary intervention is essential for a pet’s survival and well-being. Financial constraints can significantly impede access to timely care during such emergencies, underscoring the vital role of dedicated financing options like specialized credit lines designed for pet owners. Examining the intersection of dog health emergencies and accessible credit reveals the crucial function of these financial resources in ensuring optimal outcomes for canine companions.

- Unforeseen Expenses

Emergency veterinary care often entails substantial and unforeseen expenses, ranging from diagnostic testing and imaging to complex surgical procedures and hospitalization. These unexpected costs can pose significant financial challenges for pet owners. A fractured limb requiring surgery, for instance, can incur substantial costs that may strain an owner’s financial resources. Access to credit during such emergencies alleviates immediate financial burdens, enabling owners to prioritize their pet’s health without delay.

- Time-Sensitive Treatment

Many emergency conditions require immediate treatment to mitigate potential complications or prevent life-threatening consequences. Gastric dilatation-volvulus (GDV), commonly known as bloat, necessitates rapid surgical intervention. Delays in treatment due to financial constraints can significantly impact the prognosis. Accessible credit facilitates timely access to critical care, improving the chances of successful outcomes in time-sensitive emergencies.

- Emotional Distress

Dog health emergencies often induce significant emotional distress for owners, who are faced with difficult decisions regarding their pet’s care. Financial limitations can exacerbate this emotional burden, adding to the stress of an already challenging situation. Having a readily available financial resource, such as a dedicated credit line, alleviates some of this stress, allowing owners to focus on their pet’s well-being without the added pressure of immediate financial concerns.

- Long-Term Financial Planning

While emergency credit provides immediate financial relief during crises, responsible financial planning is essential for managing potential long-term costs associated with an emergency. Ongoing medications, rehabilitation therapy, or follow-up appointments can contribute to substantial expenses. Integrating emergency credit within a broader financial strategy, such as budgeting for potential veterinary costs and considering pet insurance, mitigates the long-term financial impact of unexpected health events.

The intersection of dog health emergencies and accessible credit highlights the importance of proactive financial planning for pet owners. Dedicated credit lines, employed responsibly, serve as a crucial safety net, ensuring access to vital veterinary care during unforeseen crises. By alleviating immediate financial burdens, these resources empower pet owners to prioritize their dogs’ health, maximizing the potential for positive outcomes and minimizing the emotional distress associated with emergency situations. Ultimately, accessible credit contributes significantly to responsible pet ownership by facilitating timely interventions and promoting the well-being of canine companions during critical health events.

4. Planned Procedures

Planned veterinary procedures for dogs, while not emergencies, often represent significant financial investments. These procedures, ranging from routine spaying/neutering to dental cleanings and orthopedic surgeries, contribute substantially to a dog’s long-term health and well-being. Specialized credit options, often referred to as “care credit” for dogs, play a key role in facilitating access to these planned procedures, allowing owners to provide optimal care without incurring immediate financial strain.

- Elective Surgeries

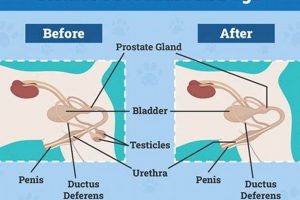

Elective surgeries, such as spaying/neutering, cruciate ligament repair, or mass removals, while medically necessary, can be scheduled in advance. These procedures often involve considerable costs, including pre-operative diagnostics, surgical fees, anesthesia, and post-operative care. Financing options allow owners to schedule these procedures proactively, preventing potential health complications that could arise from delaying treatment due to financial constraints.

- Dental Care

Dental health is crucial for a dog’s overall well-being. Professional dental cleanings, while considered routine, require anesthesia and specialized equipment, often resulting in substantial costs. Utilizing credit for dental care ensures access to these essential procedures, mitigating the risk of dental disease and its potential systemic health consequences.

- Orthopedic Procedures

Orthopedic procedures, like hip replacements or interventions for intervertebral disc disease, address mobility issues and improve a dog’s quality of life. These complex procedures typically involve significant costs. Financing options provide access to these advanced treatments, enhancing a dog’s comfort and mobility without requiring immediate, substantial out-of-pocket expenses.

- Diagnostic Testing and Imaging

Planned diagnostic procedures, such as advanced imaging (CT scans, MRI), biopsies, or allergy testing, aid in diagnosing underlying health conditions and informing treatment plans. These diagnostic tools can be costly. Access to credit facilitates comprehensive diagnostic evaluations, enabling veterinarians to develop targeted treatment strategies and improve the accuracy of diagnoses.

Planned procedures represent a significant component of responsible dog ownership, contributing significantly to a dog’s overall health and longevity. Specialized credit solutions empower owners to pursue these essential procedures proactively, mitigating potential health risks and improving quality of life. By alleviating the immediate financial burden, these financing options ensure access to vital veterinary services, ultimately promoting responsible pet ownership and enhancing the well-being of canine companions.

5. Budgeting for pet care

Budgeting for pet care forms the cornerstone of responsible pet ownership, inextricably linked to the effective utilization of financing options like specialized credit lines designed for veterinary expenses. A well-structured budget provides a framework for managing routine and unexpected costs associated with dog ownership, mitigating the risk of financial strain and ensuring access to necessary veterinary care. Exploring the components of a comprehensive pet care budget reveals its essential role in navigating the financial landscape of responsible dog ownership.

- Routine Expenses

Routine expenses encompass predictable costs associated with a dog’s daily needs and preventative care. These include food, parasite prevention, vaccinations, annual wellness exams, and licensing fees. Allocating funds for these recurring expenses establishes a stable financial foundation, enabling proactive healthcare management and reducing reliance on credit for predictable costs.

- Unexpected Costs

Unexpected costs, such as emergency veterinary visits, unforeseen illnesses, or accidents, represent a significant financial challenge for pet owners. Incorporating a contingency fund within the pet care budget provides a financial buffer for these unpredictable events, mitigating the need for immediate, extensive reliance on credit during emergencies. A designated emergency fund allows for timely intervention without incurring excessive debt.

- Long-Term Health Considerations

Long-term health considerations, including potential breed-specific predispositions to certain medical conditions or age-related health decline, necessitate financial planning for future veterinary expenses. Allocating funds for potential long-term care, such as chronic medication management or specialized diets, minimizes financial strain associated with ongoing health needs and reduces dependence on credit for foreseeable expenses.

- Integrating Credit Responsibly

Integrating credit responsibly within a comprehensive pet care budget provides a flexible financial tool for managing unexpected or substantial veterinary expenses. Utilizing credit strategically for planned procedures, emergency care, or supplementing the emergency fund allows for timely access to necessary veterinary services while maintaining financial stability. Responsible credit management, including timely repayments and adherence to credit terms, is crucial for avoiding escalating debt and preserving financial well-being.

A comprehensive pet care budget, encompassing routine expenses, provisions for unexpected costs, long-term health considerations, and the responsible integration of credit, provides a robust framework for navigating the financial responsibilities of dog ownership. By proactively addressing predictable and unpredictable expenses, a well-structured budget empowers pet owners to prioritize their dogs’ health and well-being while maintaining financial stability. Budgeting, therefore, forms an integral component of responsible pet ownership, facilitating informed financial decision-making and ensuring access to necessary veterinary care throughout a dog’s life.

6. Responsible Credit Use

Responsible credit use is paramount when financing veterinary care for dogs, especially with specialized credit lines designed for such expenses. This responsible approach ensures access to essential veterinary services without incurring unmanageable debt. The connection between responsible credit use and financing canine healthcare hinges on informed decision-making, disciplined financial management, and a clear understanding of credit terms. For instance, a pet owner facing an unexpected $2,000 veterinary bill could utilize a specialized credit line, making timely payments according to the agreed-upon terms to avoid accruing excessive interest charges. Failure to manage credit responsibly can lead to escalating debt, potentially impacting an owner’s ability to access future veterinary care when needed.

The practical significance of responsible credit use extends beyond immediate veterinary expenses. It affects long-term financial stability and influences an owner’s capacity to provide consistent care for their dog. Consider a scenario where an owner utilizes credit for a planned procedure, adhering to a structured repayment plan. This responsible approach preserves financial flexibility for future unexpected veterinary costs, ensuring the pet receives consistent care throughout its life. Conversely, accumulating excessive debt through irresponsible credit use can jeopardize an owner’s ability to afford routine preventative care, potentially leading to more significant health issues down the line.

Responsible credit use is therefore not merely a component of financing canine healthcare; it is an essential prerequisite for sustainable pet ownership. It safeguards both the pet’s well-being and the owner’s financial stability. Understanding credit terms, budgeting for repayments, and utilizing credit strategically empower pet owners to navigate veterinary expenses effectively. This proactive approach ensures access to quality veterinary care without compromising long-term financial health, reinforcing the critical link between responsible credit use and the ability to provide consistent, comprehensive care for canine companions.

Frequently Asked Questions about Financing Veterinary Care

Addressing common inquiries regarding financial resources for veterinary care provides clarity and empowers pet owners to make informed decisions regarding their dogs’ health.

Question 1: What are the eligibility requirements for veterinary credit lines?

Eligibility criteria vary among providers but typically involve a credit check and assessment of financial stability. Factors such as credit score, income, and existing debt obligations influence approval and credit limits.

Question 2: How do interest rates and fees impact the overall cost of veterinary financing?

Interest rates accrue on outstanding balances, increasing the total cost of veterinary services. Associated fees, such as annual fees or late payment charges, further contribute to the overall expense. Carefully reviewing terms and conditions before utilizing credit is essential for informed financial planning.

Question 3: What are the potential consequences of late or missed payments on veterinary credit accounts?

Late or missed payments can negatively impact credit scores, accrue additional fees, and potentially lead to collection actions. Maintaining consistent and timely payments is crucial for preserving creditworthiness and avoiding further financial complications.

Question 4: How does veterinary credit differ from general-purpose credit cards?

Veterinary credit lines are often designed specifically for healthcare expenses, sometimes offering promotional periods with deferred interest or discounts at participating veterinary practices. General-purpose credit cards may offer greater flexibility in usage but typically carry higher interest rates for non-promotional purchases.

Question 5: What steps can pet owners take to manage veterinary credit responsibly?

Creating a budget specifically for pet care, including anticipated veterinary expenses and credit repayments, is essential. Tracking spending, making timely payments, and avoiding exceeding credit limits promote responsible credit management.

Question 6: What alternatives to credit exist for financing veterinary care?

Alternatives include pet insurance, which provides reimbursement for covered veterinary expenses, and negotiating payment plans directly with veterinary providers. Establishing a dedicated savings account for pet-related costs also serves as a valuable financial buffer.

Understanding the various facets of veterinary financing empowers pet owners to make informed decisions, ensuring access to necessary care while maintaining financial stability. Responsible credit use, coupled with proactive financial planning, contributes significantly to the long-term well-being of canine companions.

For further information on managing pet healthcare finances, consult with a financial advisor or explore resources provided by reputable veterinary organizations.

Financing Canine Well-being

Access to veterinary care, often facilitated by specialized credit options designed for pet health expenses, represents a critical component of responsible dog ownership. This exploration has examined various facets of financing canine healthcare, encompassing emergency preparedness, planned procedures, budgetary considerations, and responsible credit utilization. Navigating the financial landscape of pet ownership requires a multifaceted approach, integrating proactive planning, informed decision-making, and a commitment to responsible financial management. Understanding the available resources, such as specialized credit lines, pet insurance, and established payment plans, empowers owners to make informed choices aligned with their dogs’ healthcare needs and their own financial capabilities.

The well-being of canine companions depends significantly on timely access to necessary veterinary care. Financial preparedness, supported by a clear understanding of available resources and responsible credit management practices, ensures owners can provide optimal care throughout their dogs’ lives. Proactive planning and informed financial decisions ultimately contribute to a healthier future for canine companions, underscoring the profound connection between financial responsibility and animal welfare. Continued exploration of financing options and open communication with veterinary professionals will further enhance the accessibility of quality care for dogs, fostering a stronger bond between humans and their animal companions.