A limited liability company (LLC) structure designates a business as a separate legal entity from its owners. This separation provides personal liability protection, shielding individual assets from business debts and lawsuits. For a business potentially involving animals, such as a dog training, grooming, or walking service, this structure can be particularly advantageous given the inherent risks involved in working with animals.

Choosing this business structure offers numerous advantages. It simplifies tax reporting, allows for flexible management, and enhances credibility with potential clients and partners. Historically, small businesses faced complex legal and financial hurdles. The LLC structure emerged as a streamlined alternative, offering the benefits of corporate structure without the associated administrative burdens. This has made it a popular choice for entrepreneurs in diverse fields, including those centered around animal care.

This article will further explore the practicalities and legalities involved in structuring a canine-related business as an LLC, covering topics such as registration, compliance, and insurance considerations. This information will provide a comprehensive guide for those seeking to establish and operate such a venture responsibly and successfully.

Tips for Canine-Related Businesses

Operating a successful canine-related business requires careful planning and execution. The following tips offer guidance for navigating common challenges and maximizing potential.

Tip 1: Secure Appropriate Insurance: Comprehensive liability insurance is crucial. Coverage should address potential incidents involving animals, including bites, property damage, and veterinary expenses. Policies should be tailored to the specific services offered.

Tip 2: Develop Clear Contracts: Contracts with clients should outline services, payment terms, and liability waivers. Clarity in agreements minimizes disputes and ensures smooth business operations.

Tip 3: Prioritize Safety Protocols: Establish rigorous safety procedures for handling animals. This includes staff training, appropriate equipment usage, and meticulous record-keeping.

Tip 4: Maintain Accurate Records: Detailed records of client information, animal health, and financial transactions are essential for legal and operational efficiency. These records also facilitate informed decision-making.

Tip 5: Build a Strong Reputation: Positive client relationships are fundamental to long-term success. Excellent customer service, reliable communication, and demonstrable expertise foster trust and loyalty.

Tip 6: Stay Informed About Regulations: Compliance with local, state, and federal regulations regarding animal care and business operations is paramount. Regularly review and update practices to maintain adherence.

Tip 7: Invest in Professional Development: Continuous learning in animal behavior, training techniques, and business management enhances service quality and demonstrates a commitment to excellence.

Implementing these strategies can significantly contribute to the successful operation of a canine-related business. Attention to detail, proactive risk management, and a client-centric approach are key factors in building a thriving enterprise.

By understanding the specific needs and challenges associated with working with animals, entrepreneurs can establish businesses that are both profitable and contribute positively to the well-being of the animals in their care.

1. Legal Structure

The legal structure of a canine-related business significantly impacts liability, taxation, and administrative burden. Selecting the appropriate framework, particularly the limited liability company (LLC) model, is crucial for long-term stability and protection.

- Limited Liability Protection

The LLC structure provides a crucial separation between personal and business assets. In the event of lawsuits or debts incurred by the business, personal assets of the owners remain protected. This is particularly relevant for businesses involving animals, where the risk of incidents such as bites or property damage exists. For instance, if a dog under the care of a dog walking business causes damage, the LLC structure can shield the owner’s personal assets from liability claims.

- Tax Advantages

LLCs offer flexibility in taxation. Owners can choose to be taxed as a sole proprietorship, partnership, or corporation, depending on the specific needs and circumstances of the business. This can lead to potential tax benefits and simplified tax reporting compared to other corporate structures.

- Administrative Simplicity

LLCs generally involve less complex administrative requirements than corporations. This includes simpler record-keeping, fewer mandatory meetings, and streamlined regulatory compliance. This reduced administrative burden allows business owners to focus more on operational aspects and growth.

- Credibility and Professionalism

Formally structuring a business as an LLC enhances credibility with clients, partners, and financial institutions. It signals professionalism and a commitment to legal compliance, potentially increasing trust and attracting investment.

By adopting the LLC structure, canine-related businesses can benefit from significant advantages, including liability protection, tax flexibility, and administrative simplicity. This framework offers a robust legal foundation for sustainable growth and responsible operation within the pet care industry.

2. Liability Protection

Liability protection forms a cornerstone of the limited liability company (LLC) structure, particularly for businesses operating in dynamic environments like those involving animals. For canine-related businesses, understanding the nuances of liability protection within the LLC framework is crucial for mitigating risk and ensuring long-term stability. This protection shields personal assets from business-related liabilities, offering a crucial safety net for entrepreneurs in this field.

- Direct Liability

Direct liability refers to incidents where the business owner or employee is directly responsible for harm. For example, if a dog walker fails to properly secure a leash resulting in an injury, the business could be held directly liable. The LLC structure safeguards personal assets from such claims, limiting the financial repercussions to business assets.

- Vicarious Liability

Vicarious liability extends responsibility to the business owner for actions taken by employees. If a dog groomer employed by the LLC negligently injures a dog during grooming, the business owner could be held vicariously liable. The LLC structure, again, provides a layer of protection for personal assets, even when liability arises from employee actions.

- Animal-Specific Liability

Canine-related businesses face unique liabilities due to the unpredictable nature of animals. Dog bites, property damage caused by dogs, or injuries sustained during training sessions are examples of animal-specific liabilities. The LLC structure offers a vital safeguard against these inherent risks, protecting personal assets from claims arising from animal behavior.

- Contractual Liability

Contractual liability arises from breaches of agreements with clients. For example, failure to fulfill contractual obligations regarding services, such as boarding or training, could result in legal action. The LLC structure helps delineate business obligations from personal ones, limiting the scope of personal liability in contractual disputes.

The LLC structure offers a robust shield against various forms of liability inherent in operating a canine-related business. By separating personal and business assets, this framework provides crucial protection, allowing entrepreneurs to navigate the inherent risks of the industry with greater financial security and peace of mind. This separation is critical for the sustainable operation and growth of such businesses.

3. Tax Implications

Tax implications represent a critical consideration for canine-related businesses structured as limited liability companies (LLCs). Understanding the various tax options and their potential impact on profitability is crucial for informed financial planning and sustainable operation. The choice of how an LLC is taxed significantly influences the financial obligations and administrative burden of the business.

- Pass-Through Taxation

LLCs commonly utilize pass-through taxation, meaning profits and losses are “passed through” to the owners and reported on their individual income tax returns. This avoids the double taxation often associated with corporations, where profits are taxed at both the corporate and individual levels. This structure simplifies tax reporting and can potentially reduce the overall tax burden for business owners. For a dog grooming business structured as an LLC, pass-through taxation means the owner reports business profits and losses on their personal income tax return.

- S Corporation Election

LLCs can elect to be taxed as an S corporation. This structure allows owners to receive a salary and also take distributions, potentially reducing self-employment tax obligations. However, this option involves more complex administrative requirements, including payroll processing and adherence to stricter regulatory guidelines. A dog training business electing S corp taxation must manage payroll for employee-owners and adhere to specific IRS regulations.

- Deductible Expenses

Operating a canine-related business incurs various expenses, many of which are deductible for tax purposes. These can include costs associated with pet supplies, facility rental, marketing, and professional services like veterinary care. Accurately tracking and categorizing these expenses is essential for maximizing deductions and minimizing tax liability. A dog walking business can deduct expenses such as leash purchases, dog treats, and marketing materials used to promote services.

- State and Local Taxes

Beyond federal taxes, canine-related LLCs must also comply with state and local tax regulations. These can include state income taxes, sales taxes, and specific taxes related to operating a business within a particular jurisdiction. Understanding and adhering to these regulations is essential for maintaining legal compliance and avoiding penalties. A dog boarding business operating in a specific city may be subject to local business license fees and sales taxes on services rendered.

Navigating the tax landscape for a canine-related LLC requires careful consideration of these various factors. Choosing the appropriate tax structure and meticulously managing deductible expenses are crucial for minimizing tax liability and maximizing profitability. Furthermore, compliance with all applicable federal, state, and local tax regulations is paramount for sustainable and legally sound business operations.

4. Regulatory Compliance

Regulatory compliance forms a critical aspect of operating a canine-related limited liability company (LLC). Adhering to relevant regulations ensures legal operation, safeguards animal welfare, and builds public trust. Navigating these legal requirements is essential for establishing a reputable and sustainable business within the pet care industry. Overlooking these crucial aspects can lead to penalties, legal repercussions, and reputational damage.

- Business Licenses and Permits

Obtaining the necessary business licenses and permits is a foundational step for legal operation. Requirements vary depending on location and specific business activities, such as dog training, grooming, or boarding. For example, a dog daycare center must secure a kennel license and comply with local zoning regulations. Failure to obtain required licenses can result in fines and operational restrictions.

- Animal Welfare Regulations

Compliance with animal welfare regulations is paramount for ethical and legal operation. These regulations often cover aspects like housing conditions, sanitation, veterinary care, and handling practices. A dog boarding facility must adhere to specific requirements regarding cage size, ventilation, and exercise provisions. Non-compliance can lead to legal sanctions and damage to the business’s reputation.

- Zoning Ordinances

Local zoning ordinances dictate where specific business types can operate. These regulations often restrict operating a canine-related business in residential areas or impose limitations on the number of animals allowed. A dog grooming business operating from a residential property must comply with local zoning regulations regarding home-based businesses. Ignoring zoning restrictions can result in fines and forced relocation.

- Waste Disposal Regulations

Proper waste disposal is crucial for maintaining sanitary conditions and complying with environmental regulations. Canine-related businesses must adhere to specific guidelines for disposing of animal waste. A dog walking business must ensure proper disposal of dog waste during walks, adhering to local ordinances regarding public sanitation. Failure to comply can result in fines and negative public perception.

Meticulous adherence to these regulatory requirements is not merely a legal obligation but a demonstration of responsible business practices. Compliance fosters public trust, safeguards animal welfare, and contributes to the long-term sustainability of the canine-related LLC. By prioritizing regulatory compliance, businesses demonstrate a commitment to ethical operations and build a strong foundation for success within the pet care industry. This proactive approach mitigates legal risks and strengthens the business’s standing within the community.

5. Operational Procedures

Well-defined operational procedures are essential for the smooth and efficient functioning of any business, especially those involving animals. In the context of a canine-related limited liability company (LLC), establishing clear operational procedures ensures not only business efficiency but also the safety and well-being of the animals in its care. These procedures act as a blueprint for daily operations, guiding staff actions and ensuring consistent service delivery.

- Client Onboarding

A standardized client onboarding process is crucial. This includes collecting comprehensive information about the dog, such as breed, age, temperament, medical history, and emergency contact details. A clear onboarding process ensures all necessary information is gathered, minimizing potential risks and enabling informed decision-making regarding suitable services. For example, a dog daycare requiring proof of vaccinations during onboarding mitigates health risks to other dogs in the facility.

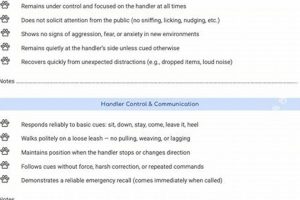

- Daily Handling Protocols

Specific protocols for handling dogs are essential for ensuring their safety and well-being. These protocols should cover leashing procedures, feeding schedules, exercise routines, and methods for managing different temperaments. Clear guidelines minimize the risk of incidents and ensure consistent care. For instance, a dog walking business implementing designated leashing areas within their facility reduces the risk of escapes or altercations.

- Emergency Procedures

Establishing clear emergency procedures is crucial for handling unexpected situations. This includes protocols for handling medical emergencies, animal escapes, or aggressive behavior. Having pre-defined procedures ensures swift and appropriate action in critical situations. A dog boarding facility having a readily available list of emergency veterinary contacts and established transport procedures demonstrates preparedness for unforeseen medical needs.

- Record Keeping

Maintaining meticulous records is fundamental to operational efficiency and legal compliance. This includes documenting client information, animal health records, incident reports, and financial transactions. Detailed record-keeping facilitates effective communication, supports informed decision-making, and ensures accountability. A dog grooming business maintaining detailed grooming records, noting specific client requests and any observed skin conditions, demonstrates professionalism and attention to detail.

These operational procedures form the backbone of a successful canine-related LLC. They contribute to a safe and efficient working environment, enhance the quality of care provided to the animals, and minimize potential liabilities. By implementing and consistently adhering to these procedures, the business demonstrates a commitment to professionalism, responsible animal care, and long-term sustainability within the pet care industry. Furthermore, well-defined procedures contribute to building client trust and fostering a positive reputation within the community.

Frequently Asked Questions

This section addresses common inquiries regarding the formation and operation of a limited liability company (LLC) within the canine industry, providing clarity on key legal and practical considerations.

Question 1: What are the primary advantages of structuring a canine-related business as an LLC?

The LLC structure offers several key benefits, including personal liability protection, separating personal assets from business debts and lawsuits. It also provides tax flexibility and simplified administrative requirements compared to other corporate structures.

Question 2: How does an LLC protect personal assets in a canine-related business?

The LLC creates a separate legal entity, shielding personal assets from business liabilities. In the event of lawsuits related to dog bites, property damage, or other incidents, personal assets remain protected.

Question 3: What are the tax implications of operating a canine-related LLC?

LLCs can choose to be taxed as a sole proprietorship, partnership, or corporation, offering flexibility depending on the business’s financial situation. Understanding these options and consulting with a tax professional is crucial for optimizing tax strategies.

Question 4: What regulatory requirements must canine-related LLCs comply with?

Compliance requirements vary by jurisdiction but often include obtaining business licenses, adhering to animal welfare regulations, complying with zoning ordinances, and ensuring proper waste disposal practices. Thorough research and adherence to these regulations are essential for legal operation.

Question 5: How do operational procedures contribute to the success of a canine-related LLC?

Well-defined operational procedures, encompassing client onboarding, daily handling protocols, emergency procedures, and meticulous record-keeping, ensure efficient and safe business operations, contributing to client satisfaction and mitigating potential risks.

Question 6: Where can one find further resources regarding forming and operating an LLC in the canine industry?

Resources such as the Small Business Administration (SBA), state-specific business development centers, and legal professionals specializing in business formation can provide valuable guidance and support in navigating the legal and operational complexities of establishing a canine-related LLC.

Understanding these aspects provides a solid foundation for making informed decisions regarding structuring and operating a canine-related business. Due diligence and proactive planning contribute significantly to long-term success and responsible business practices.

For a comprehensive overview of business insurance options specifically tailored to the canine industry, please continue to the next section.

Conclusion

Establishing a limited liability company (LLC) provides a robust framework for canine-related businesses, offering crucial liability protection, tax advantages, and administrative efficiency. Navigating the legal and regulatory landscape requires careful consideration of licensing, animal welfare regulations, and operational procedures. Prioritizing these elements ensures not only legal compliance but also fosters trust with clients and safeguards animal well-being, contributing to a sustainable and ethical business model.

The evolving landscape of animal care necessitates continuous adaptation and adherence to best practices. Proactive engagement with legal and regulatory updates, coupled with a client-centric approach, ensures responsible and successful operation within this dynamic industry. Building a thriving enterprise requires a commitment to both legal compliance and the highest standards of animal care.